Cross-organization collaboration in software supply chains

As the software landscape proves increasingly competitive, one avenue for sustainable innovation and competitive advantage is value chain innovations. Across the software supply chain, we are always looking to improve the value returned to the customer.

Cross-organization collaboration is one area we don’t often venture into; our borders are inflexible, and handoffs across the supply chain are distinct and one-way. But is this the best configuration?

“The true challenge, however, is to accomplish this alignment across all components of the supply chain to ensure the same level of coordination and collaboration that can exist within one firm. The challenge of serving as a catalyst to bring together the skills and capabilities of independent companies working together to accomplish mutually achievable goals is a non-trivial problem.”

– Davis and Spekman, (2004, p. xvii).

Cross-organizational collaboration to add value

There’s considerable precedent for these innovative value chain networks among manufacturing organizations. Cross-disciplinary teams work across organizational boundaries, with a holistic perspective on the value creation network. They improve their competitive position through simplification, synchronization, integration, and automation. Time-to-market improves, product revenue grows, costs shrink, and quality improves through operational excellence.

You can view some innovative, collaborative efforts in the World Economic Forum’s 2019 Whitepaper, Supply Chain Collaboration through Advanced Manufacturing Technologies. Unfortunately, this idea is not widespread within the software industry. Rather, acquisitions, mergers, and aggressive competition lead to minimal cross-organizational collaboration. Companies hoard intellectual property, the bigger fish simply eat the competition, and handoffs between company boundaries are generally well-defined one-way transactions.

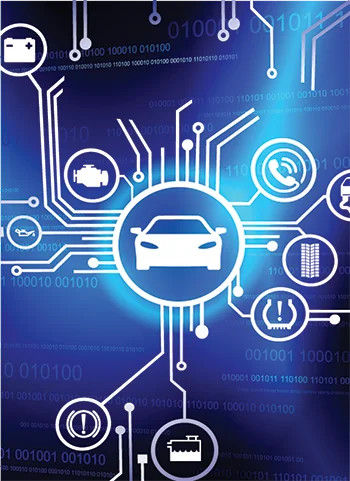

One rare and unique success in this area is firms that coordinate the outsourced development of the software features as product bundles within the design of core physical products (Joglekar & Rosenthal, 2003). For example, the automobile industry adopted telematics, an onboard service for automobile drivers and passengers within its core physical product—the automobile and truck.

Telematics devices incorporate sensor and microprocessor hardware components. These product bundles are integrated with other product software features (e.g., automotive information systems, the global positioning system (GPS), and wireless communications). Thus, outsourced telematics development has been achieved and integrated within the automobile’s design and development.

Cloud vendors and cross-organization collaboration

A notable exception to value chain collaborative resistance is the cloud vendors, although they are companies who themselves have indeed eaten the competition and smaller innovators along the way. There are unique products, information, knowledge, and cash flow between organizations and cloud providers, with collaborative relationships enabling successful end-customer outcomes. Yet these relationships don’t resemble the collaborative relationships of organizational partners of a similar size.

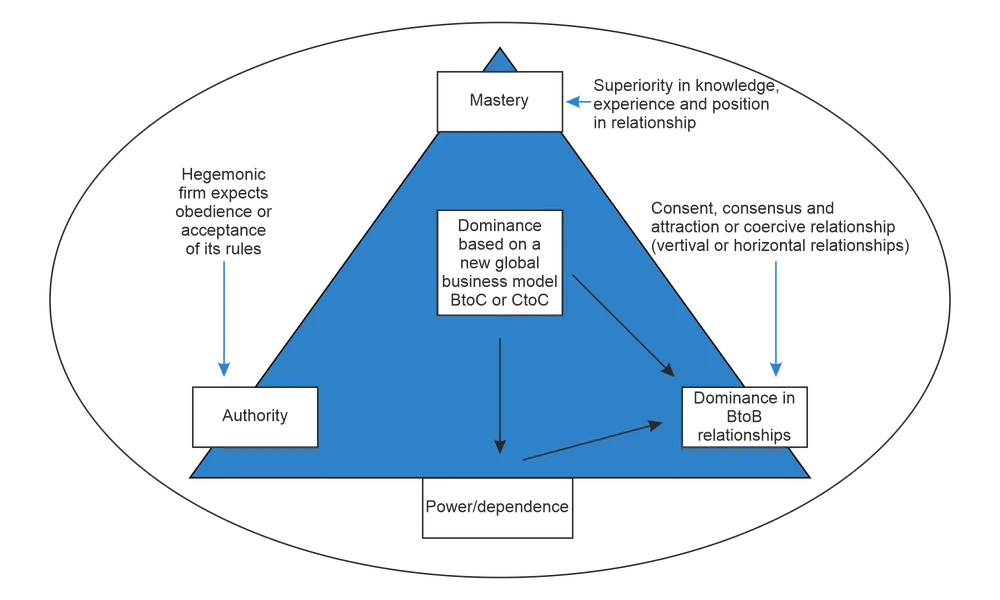

Relationships among two large or smaller players appear as partnerships or peer-level collaboration; this is what we mainly discuss when referring to cross-organization collaboration. However, hegemony dependencies best describe relationships between most organizations and cloud vendors. “Hegemony is used here to describe the additional power that accrues to a dominant group by its ability to convincingly present its particular interests as universal and, by doing so, win the consent of those dominated by it” (Ben-Porat, 2005, p. 328).

The leading cloud vendors have enormous market capitalizations compared to the average company consuming their services. The cloud vendors define the interfaces and nature of product, information, knowledge, and cash flow - in other words, the pace and style of collaborations.

This asymmetry is not necessarily bad. Improved technology standards and diffusion of software development best practices could be attributed to the cloud vendors. Consider Kubernetes – regarded as the new operating system for applications and toolchains alike. Google open-sourced this technology, defined the ‘where’ and ‘how’ its customers/partners could use it, and promoted the approach such that other cloud vendors have implemented similar offerings.

Even though the relationship is relatively one-sided, it still adds value. We can go beyond this dependent relationship towards more balanced collaborations. Johnsen, et al., (2020, p. 76-78) identified three characteristics of hegemony in customer-supplier relationships (see Figure 1):

- Dominance—which implies a higher position that enables a hegemonic actor to be more noticeable in its actions and interactions with others and more attractive to relationship counterparts than other potential partners. The dominant firm can adopt a position across a spectrum from coercion/control to benevolent/paternalistic encouragement.

- Authority—which involves the right to give orders, make decisions or enforce obedience. In a hegemonic relationship, this implies that the customer is in a position of ascendancy and has authoritative rule and precedence over its relationship counterparts. The control mechanism for authority in hegemonic relationships is through coercion - actual or potential - and the spatial domain of influence is evidenced through contractual terms.

- Mastery—which involves the far-reaching control or superiority of the customer over the supplier, and in contrast to traditional notions of power, its reach in hegemonic situations stretches beyond contracts and markets… Mastery is imposed on, but voluntarily accepted by, the weaker party despite the potential for long-term stagnation of the supplier’s capabilities and independent development.

Next steps: Consider collaborating with competitors and companies the enterprise would like to acquire

Besides the leading cloud vendors, which organizations do the enterprise already collaborate with? Could additional products, information, knowledge, and cash flow between partners improve the enterprise’s competitive position? Is the enterprise willing to trust partners, including making confidential information available, to realize these benefits? Are there vendors, competitors, and service providers where a collaborative, rather than a one-way, competitive relationship could add value?

We may have a long way to go, especially given a software firm’s current aggressive competitive behavior. Nevertheless, the future looks promising with value creation networks spanning many firms, collaborative relationships underpinning strong value chains, and a more efficient and effective flow of products, information, knowledge, and cash across organizations. And, as with other supply chain relationships, we can model and manage these collaborative relationships in the software supply chain by defining and improving them over time.

References:

Ben-Porat, G. (2005). Between power and hegemony; business communities in peace processes. Review of International Studies, 31(2), 325-348.

Davis, E. W., & Spekman, R. E. (2004). The extended enterprise: Gaining competitive advantage through collaborative supply chains. FT press.

Joglekar, N. R., & Rosenthal, S. R. (2003). Coordination of design supply chains for bundling physical and software products. Journal of Product Innovation Management, 20(5), 374-390.

Johnsen, R. E., Lacoste, S., & Meehan, J. (2020). Hegemony in asymmetric customer-supplier relationships. Industrial Marketing Management, 87, 63-75.